FINANCIAL PLANNING & INVESTMENTS

How We Work With Clients

We build financial plans and portfolios for clients to help them reach their goals. While we do not believe money equates to happiness, we do believe that financial success helps set the foundation for you to best explore what provides you fulfillment throughout all stages of life.

We believe that we can deliver tremendous value to you when there is a proper understanding of your life circumstances, concerns, and goals. For that reason, we pride ourselves in the deep relationships we develop over years with our clients.

We accomplish that through regular meetings, honest conversations, and an ongoing commitment to provide thoughtful analysis and insight.

The Layline Process

Plan

We ask about your priorities and concerns, then turn your answers into action.

Invest

We identify the right asset allocation to achieve your long-term goals.

Monitor

We regularly review, update, and optimize your action plan.

Financial Planning

Creating a shared vision is the foundation of our relationship.

- Our deep-dive process lets us get to know you, what drives you, and which goals are important to you. Only then can we deliver analyses and advice that are tailored to your needs.

- While every plan varies, we’ll always address such topics as cash flow, net worth, retirement, asset allocation, taxes, protection, and estate planning.

- Our collaborative planning tools and technology allow for a continuous dialogue and fluid planning process so that you receive the most timely and relevant advice based on your current life circumstances.

- Objectivity is our focus. Because we do not sell products such as insurance or annuities, we are able to minimize our conflicts of interest and help you make planning decisions that are in your best interest.

- If we succeed at our job, we are providing you clarity, focus, and peace of mind.

Investment Management

Building and managing tailored portfolios for every client need.

- Our portfolios are designed to align with your risk tolerance, goals, and time horizon.

- We believe in focusing on long-term asset allocation, applying a rules-based approach to allocation changes and rebalancing, and minimizing investment costs.

- Our core portfolios consist of mostly low-cost exchange-traded funds (ETFs) and sometimes mutual funds depending on what we determine is the best approach to a particular asset class.

- We also offer other strategies, such as an individual equity portfolio, depending on your situation.

- We manage client assets with full discretion at Charles Schwab.

Monitoring The Plan

Putting your plan in place is only the first step.

- Regularly communicating, adjusting your plan, and monitoring your investments is what drives continued success.

- We’ll revisit your goals and track your progress to ensure you’re on track.

- Our cloud-based planning and investment tools allow you to view your progress and financial standing from your computer or phone – in real time.

Regarding Our Pricing, Clarity Creates Confidence:

If you’ve ever been confused by how financial advisors are compensated, you’re not alone. Our fees are clear and straightforward to give you instant peace of mind – and give us the freedom to build plans with no outside influences.

Standard financial planning costs $2,500 annually*. Clients are billed quarterly, with no commitment after the first year.

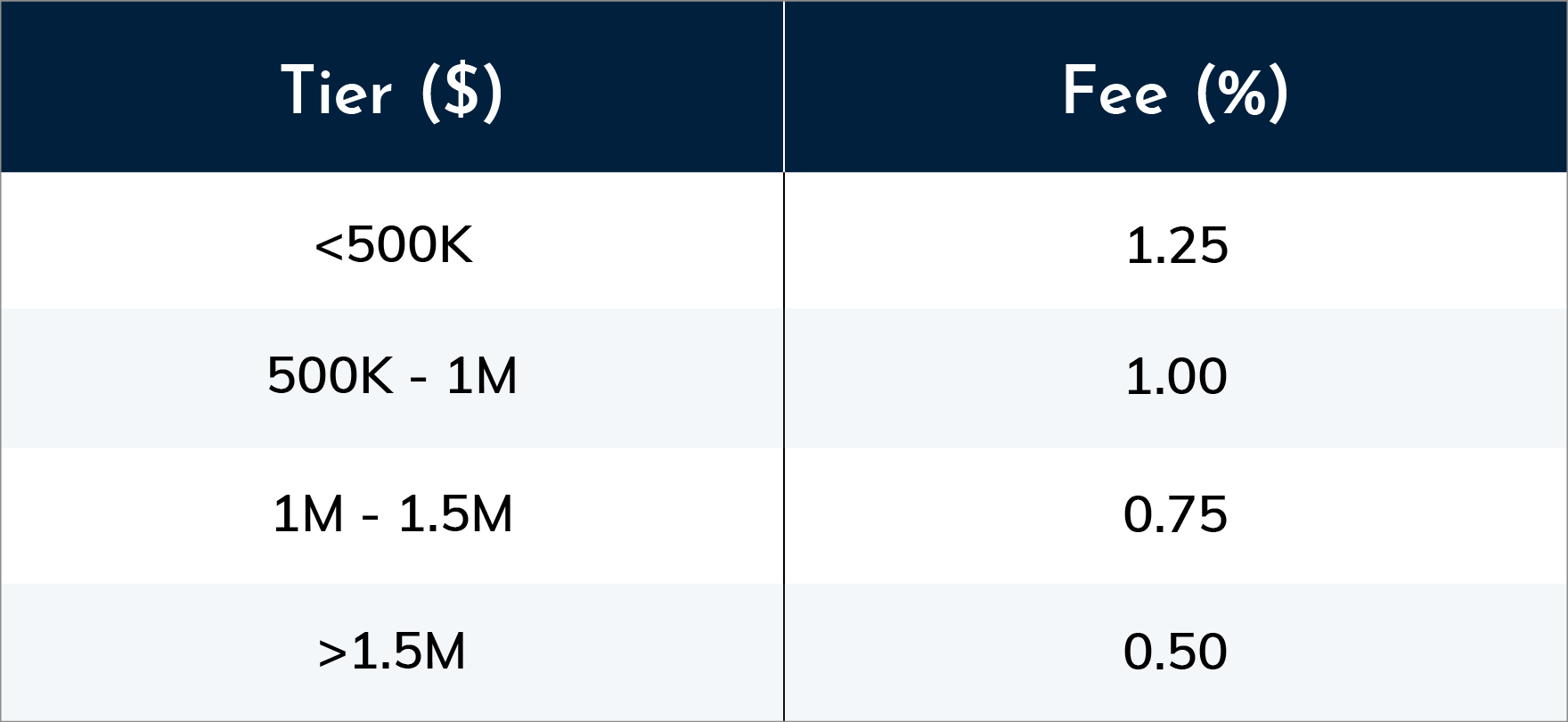

Investment management fees are based on the below blended tier schedule. For clients who invest $250,000 or more with us, we waive the annual planning fee*.

*Costs may vary depending on the client’s particular needs. Please see our ADV for a full description of services and costs.

Ready to start the Conversation?

For more information on ESG Investing:

LAYLINE ADVISORS, LLC (“LAYLINE ADVISORS”) is a registered investment adviser with the SEC. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, LAYLINE ADVISORS disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. LAYLINE ADVISORS does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall LAYLINE ADVISORS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if LAYLINE ADVISORS or a LAYLINE ADVISORS authorized representative has been advised of the possibility of such damages. In no event shall LAYLINE ADVISORS, LLC have any liability to you for damages, losses and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.